Program: Python Code for Exotic Option Trading

Complete Code and Question is available here

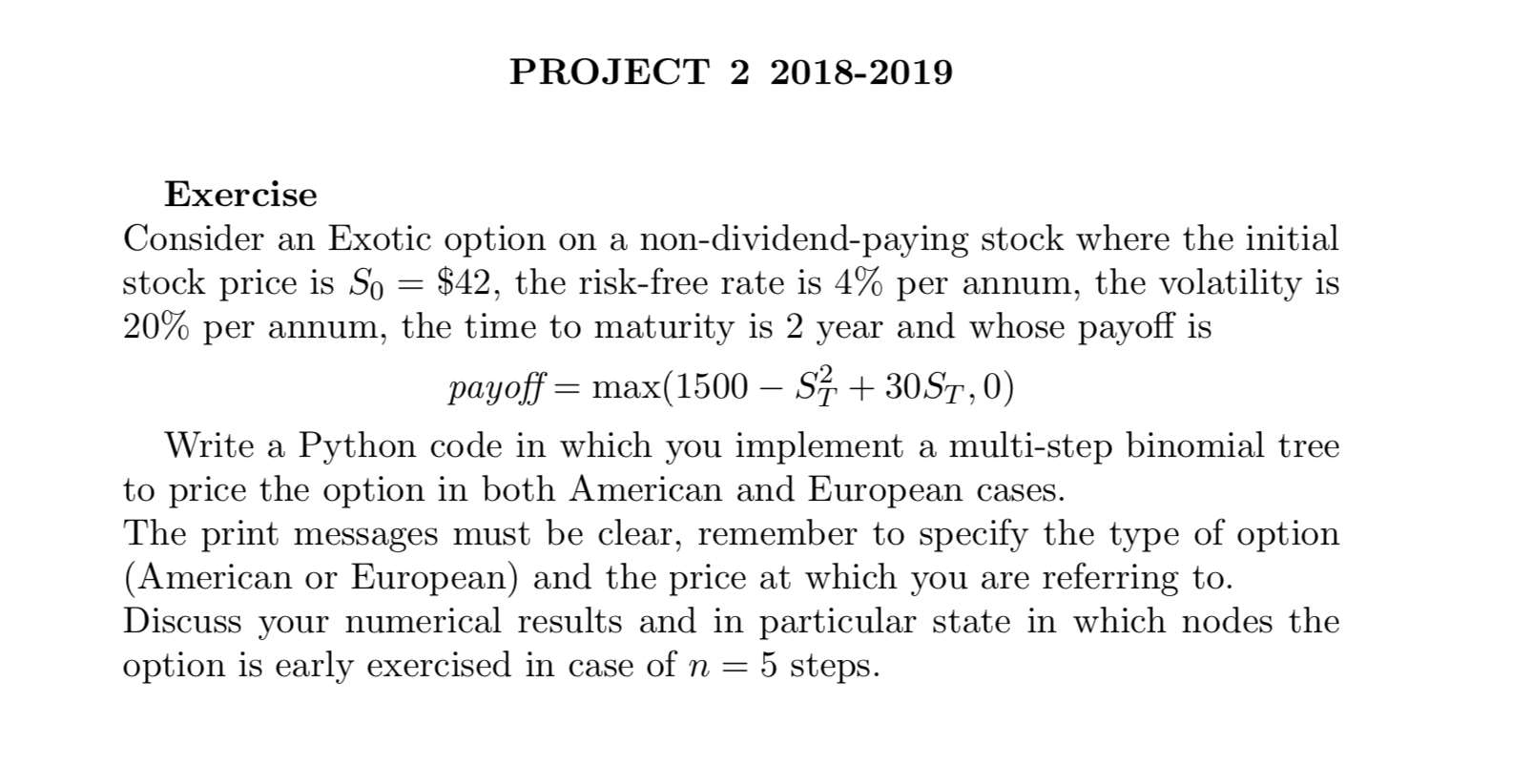

Question

Solution

import math

import numpy as np

#Initial value of asset

initial_S0 = 42

#Risk free rate

risk_free_rate = 0.04

#volatility

volatility = 0.2

#time_to_maturity = 2

#delta time or number of intervals within exercise time

delta_t = float(input("Enter number of time intervals : "))

#Exercise time

number_years = 2

#Adding one because ther is always one extra value at each interval

n = int(delta_t)+1

#Calculating the subintervals or time for each period

delta_t = float(number_years/delta_t)

#u value from volatility and delta (up value)

u = math.exp(volatility*math.sqrt(delta_t))

#d value from volatility and delta (down value)

d = math.exp(-volatility*math.sqrt(delta_t))

#Calculating the qu(Probability og up) value

q_u = (math.exp(risk_free_rate * delta_t) - d)/(u-d)

#Matrix to store current asset price

S_matrix = np.zeros([n,n])

#Setting the first assest price

S_matrix[0,0] = initial_S0

print("\n")

print("u:",u,"d:",d, "qu",q_u,"qd",1-q_u)

#Calculating the asset price at for each interval

for j in range(1,n):

for i in range(0,j+1):

S_matrix[j,i] = initial_S0*(u**i)*(d**(j-i))

#Transpose the asset price martix to which would be easy to work

S_matrix = np.transpose(S_matrix)

#Matrix to store American options

optionprice_American = np.zeros([n,n])

#Matrix to store Europian options

optionprice_Europian = np.zeros([n,n])

#Payoff for europian

optionprice_Europian[:, n - 1] = [(max(1500-(x**2)+(30*x),0)) for x in S_matrix[:, n - 1]]

#Calculating the option prices europian

for j in range(n-2,-1,-1):

for i in range(0,j+1):

optionprice_Europian[i,j] = math.exp(-risk_free_rate*delta_t)*((q_u*optionprice_Europian[i+1,j+1])+((1-q_u)*optionprice_Europian[i,j+1]))

#Calculating the Payoff American

optionprice_American[:, n - 1] = [(max(1500-(x**2)+(30*x),0)) for x in S_matrix[:, n - 1]]

#print(optionprice_American)

#Calculating the option prices American

for j in range(n-2,-1,-1):

for i in range(0,j+1):

optionprice_American[i,j] = max((1500-(S_matrix[i,j]**2)+(30*S_matrix[i,j])),math.exp(-risk_free_rate*delta_t)*((q_u*optionprice_American[i+1,j+1])+((1-q_u)*optionprice_American[i,j+1])))

print("\n")

print("Assest Price:")

print(S_matrix[:,:])

print("\n")

print("American option:")

print(optionprice_American[:,:])

print("\n")

print("Europian option:")

print(optionprice_Europian[:,:])

print("\n")

print("Optimal Option:")

#Optimal Option:

optimal_option = np.zeros([n-1,n-1])

count = 0

#Early Exercise is optimal are nodes (j,i) and option value at optimal early exercise

for j in range(n-2,-1,-1):

for i in range(0,j+1):

k = max((1500-(S_matrix[i,j]**2)+(30*S_matrix[i,j])),0)

if(max(k,optionprice_American[i,j]) <= k and k > 0 ):

count+=1

print("Early exercise is optimal at:",j,i,"And Option Value at this node is:",k)

print("\n")

print("Numbber of optimal early exercise:",count)